Working Paper

Asymmetric Labor Income Risk: Implications for Risk-Taking in Financial Markets

[SSRN]|

[SLIDES]

Show Abstract

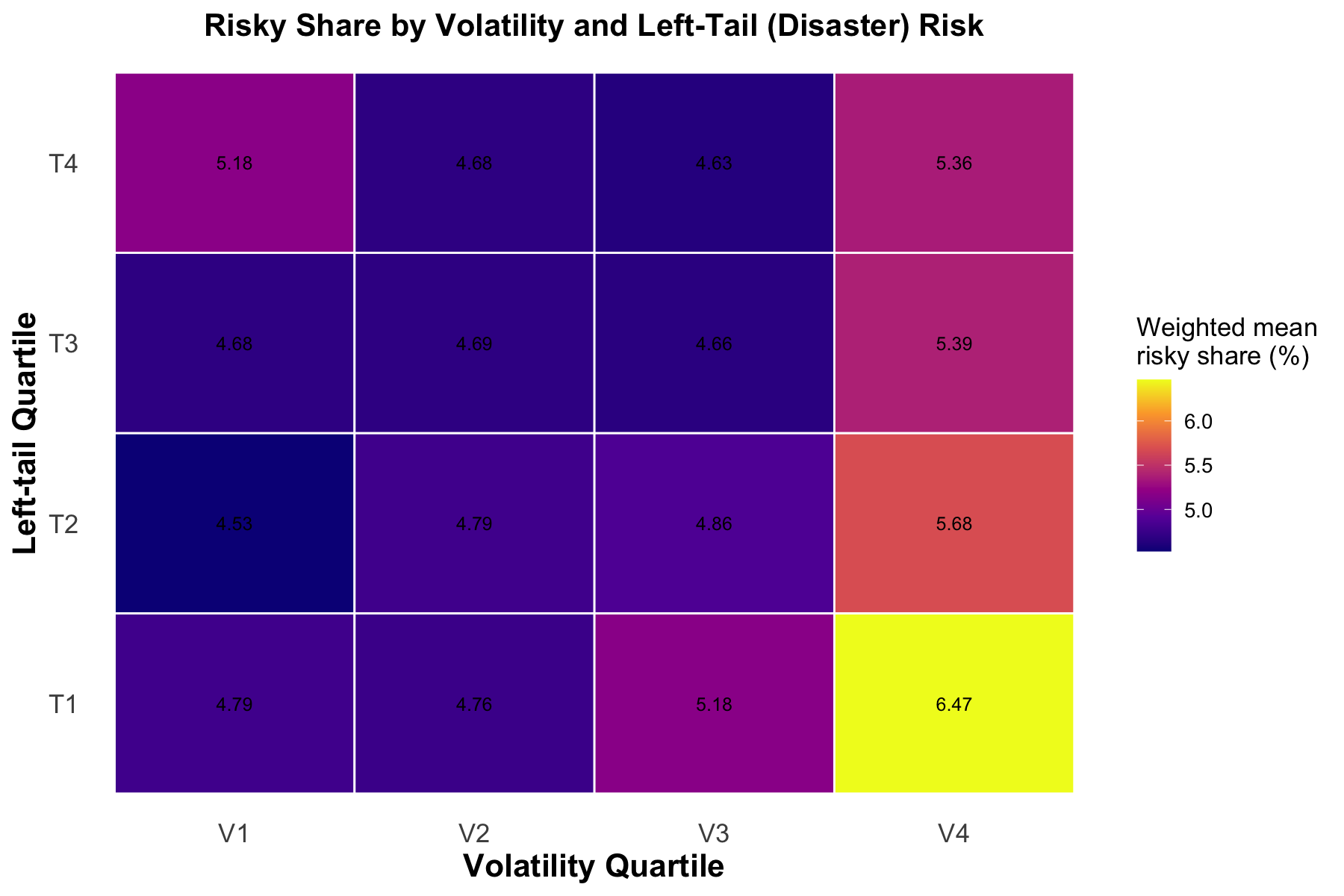

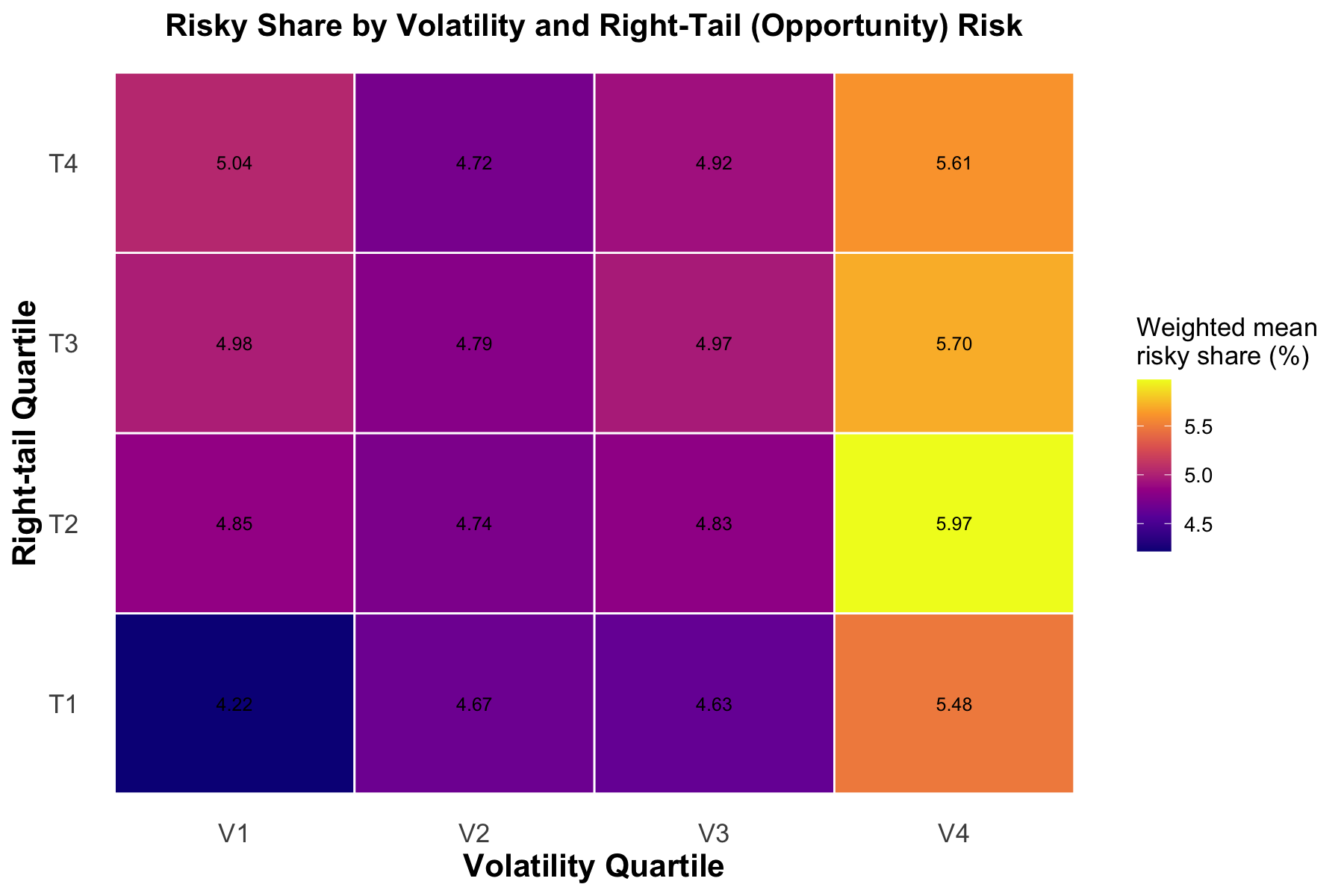

Abstract: The literature has documented a counterintuitive positive link between earnings volatility and stock holdings, posing a puzzle to researchers. I illustrate that this link is driven almost entirely by the right tail of the earnings distribution. Using the Survey of Income and Program Participation (SIPP), I construct a tail-dependent measure that interacts individuals’ labor income growth variance with its skewness. Holding income volatility constant, investors exposed to right-tail shocks (opportunity risk) increase their equity share, while those facing left-tail shocks (disaster risk) sharply reduce it. Moreover, the tail effects are asymmetric: left-tail risk hurts virtually all investors, whereas right-tail risk benefits only a subset. These results show that higher-order moments of labor-income risk shape portfolio choice, highlight the limitations of variance-based uncertainty metrics, and offer micro-level support for more robust portfolio-choice models.

Presented at: USI IdEP Brown Bag (USI, 2023, 2024, 2025), 2nd Workshop on Applied Macroeconomics and Monetary Policy (University of St. Gallen, 2024), Frankfurt Summer School 2024 (The Deutsche Bundesbank, 2024), Macro Finance Research Program (MFR) 2024 Summer Session for Young Scholars (University of Chicago, 2024), Gerzensee Alumni Conference (Study Center Gerzensee, 2024, 2025), RES PhD Conference 2024 (University of Portsmouth, 2024), German Finance Association (DGF) Annual Meeting 2025 Doctoral Workshop (University of Hagen, 2025), 10th Luxembourg Workshop on Household Finance and Consumption (Central Bank of Luxembourg, 2025), SFI PhD Student workshop (University of Zurich, 2025), 19th International Behavioural Finance Conference (Booth School of Business, 2025), 14th International Moscow Finance Conference (HSE Moscow, 2025), AFA 2026 (Philadelphia, 2026)

Hide Figures

Navigating Through Fear and Greed: The Experience-Driven Disposition Effect [SSRN]

with Rong Liu (TJU),

Jessica Wachter (Wharton),

Michael Kahana (UPenn) and

Yongjie Zhang (TJU)

Show Abstract

Abstract: Using transaction-level data on Chinese retail investors across a boom–bust cycle, we study how salient realized outcomes shape the disposition effect. We measure experience as counts of large realized gains or losses and find a sharp asymmetry: sequences of large gains attenuate the disposition effect, whereas sequences of large losses amplify it. To account for these facts, we develop a disciplined memory-based recall model in which similarity-weighted retrieval of past outcomes guides sell decisions. The model reproduces both the baseline disposition effect and the documented asymmetries, highlighting the critical—and asymmetric—role of experience in shaping trading behavior.

Presented at: USI IdEP Brown Bag (USI, 2024), Memory, Beliefs, and Choice (University of Pennsylvania, 2025)

When Risk Stops Mattering: Speculative Demand and Price Uncertainty in Housing Markets

Show Abstract

Abstract: I examine speculative behavior in Beijing’s resale housing market using a newly assembled micro-level dataset of over half a million broker-mediated transactions from 2015 to 2021. Exploiting the boom-and-bust cycle in housing prices during the late 2010s, I find that the relationship between price uncertainty and expected returns is attenuated during periods of heightened speculation—suggesting that buyers become less sensitive to idiosyncratic valuation risk. This pattern is consistent with a shift toward short-term, risk-tolerant investors as the market heats up. Following the introduction of political signals discouraging speculation—such as informal purchase quota warnings—price uncertainty becomes significantly more negatively associated with expected returns. These findings suggest that even non-binding government rhetoric can restore sensitivity to valuation risk and moderate speculative dynamics in illiquid, heterogeneous asset markets like housing.

Presented at: USI IdEP Brown Bag (USI, 2024)

Tax Regime and Organizational Choice: Evidence from China’s VAT Expansion

Show Abstract

Abstract: I study how shifting from gross-receipts taxation to value-added taxation affects organizational form at entry. Using a new province–industry–year panel of Chinese registrations (1960–2022), I construct a province-level VAT coverage intensity—the share of local stock in VAT-covered services—based on the pre-2016 pilot scope and the nationwide expansion on May 1, 2016. A two-way fixed-effects design relates the formal entry share to coverage intensity. To address endogeneity, I use a Bartik instrument that interacts pre-2011 industry shares with time-varying national coverage by industry. The first stage is strong. IV estimates imply that a 10-percentage-point increase in coverage raises the formal entry share by 0.13 percentage points, consistent with input-credit and invoice-chain mechanisms.

Presented at: TBC

Work in Progress

Consumption under Constraints: Uncovering Inequality in Discretionary Spending

Presented at: USI IdEP Brown Bag (USI, 2022)

Tax-Induced Labor Supply Distortions and Household Welfare: Evidence from Japan

慶應義塾大学パネルデータ設計・解析センター(PDRC)プロジェクトID:7545

Panel Data Research Center (PDRC) at Keio University Project ID: 7545

Coding & Resources

Python

Here is a highly recommended course to learn Python coding for economics:

Matlab

- Structural Estimation: Placeholder

A very good introductory lecture on structural estimation is available on YouTube, offered by Prof. Michael Keane.

R

- Structural Estimation: Placeholder

Investment Journey

This page documents my investment journey beginning in 2025. I will track and report the realized returns for each investment.

Portfolio as of April 16, 2025

On February 5, 2025, I purchased the following stocks in response to the AI boom in China:

- Alibaba – 28.1% allocation at HKD 97.00 per share; realized on February 13, 2025 at HKD 115.40.

- HSBC – 46.4% allocation at HKD 80.15 per share; realized on March 11, 2025 at HKD 85.00.

- Xiaomi (W) – 25.5% allocation at HKD 39.15 per share; realized on February 13, 2025 at HKD 41.80.